China and Hong Kong stock markets rebounded sharply on Tuesday, April 8, 2025, regaining some lost ground after suffering one of their worst sell-offs in years. The turnaround came as investors responded to signs of direct support from Chinese authorities and a broader stabilization across Asian markets.

Market Recovery After Heavy Losses

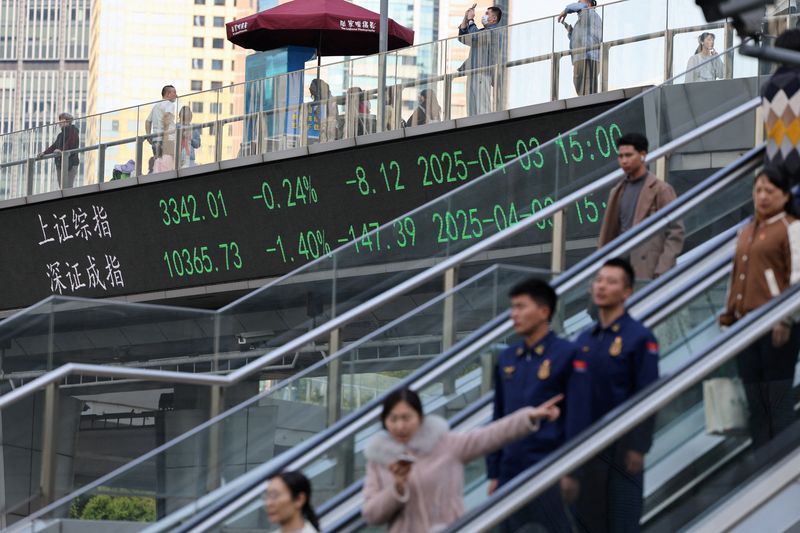

The CSI 300 Index, which tracks the largest blue-chip stocks on the Shanghai and Shenzhen exchanges, rose by 1%, while the Shanghai Composite gained 0.9%. This modest but significant recovery followed Monday’s dramatic plunge of over 7%, which had shaken investor confidence across the region.

In Hong Kong, the Hang Seng Index climbed 1.6% after falling more than 13% in the previous session—its biggest single-day percentage drop since the 1997 Asian financial crisis. The Hang Seng Tech Index also bounced back by 3.6%, recouping some losses from Monday’s 17% nosedive, which was triggered by rising trade tensions and economic uncertainty.

Beijing’s Market Stabilization Efforts

The recovery was widely attributed to decisive action from Beijing. China’s sovereign wealth fund, Central Huijin, along with other major state-backed institutions, increased their purchases of domestic stocks. These moves were interpreted as a clear signal that the Chinese government was stepping in to restore calm and limit further market panic.

In addition to equity purchases, Chinese regulators encouraged listed firms to conduct share buybacks and increase dividend payouts to boost investor confidence. Trading volumes in several exchange-traded funds (ETFs) linked to Central Huijin hit record levels, suggesting a coordinated and strategic effort to stabilize the financial system.

The State Administration of Foreign Exchange (SAFE) also reiterated its commitment to maintaining currency stability and controlling capital outflows, easing some fears of financial contagion.

Tariff Tensions Loom in the Background

The market turmoil this week was largely driven by renewed trade hostilities between the U.S. and China. President Trump’s administration imposed a steep 34% tariff on a wide range of Chinese goods, citing unfair trade practices and national security risks. In response, Beijing announced retaliatory tariffs of equal value and vowed to defend its economic interests.

Although tensions remain high, investors were cautiously optimistic that both sides may return to the negotiating table. Analysts noted that China’s show of market support and strong messaging may be aimed at reducing domestic volatility while signaling resilience to the international community.

Regional Sentiment Improves Slightly

Elsewhere in Asia, markets echoed the rebound. Japan’s Nikkei 225 surged by 5% as fears of global recession subsided slightly, and South Korea’s KOSPI gained 2.1%. The broader MSCI Asia-Pacific Index outside Japan ticked up 0.2%, marking a pause in the recent sell-off across global equities.

U.S. stock futures also pointed to a higher open, further contributing to the positive tone in Asia.

Analysts Urge Caution Amid Uncertainty

Despite Tuesday’s rebound, market experts remain cautious. “This is a relief rally, not a reversal of trend,” said Chen Yu, a senior strategist at China Merchants Securities. “The underlying issues, particularly the escalating trade war and fragile investor sentiment, have not been resolved.”

Volatility is expected to remain elevated in the near term as traders weigh policy responses, corporate earnings, and geopolitical developments.

Conclusion

While China’s and Hong Kong’s equity markets showed signs of stabilization, risks remain high amid a turbulent global environment. The effectiveness of Beijing’s interventions and the trajectory of U.S.-China trade relations will likely determine the sustainability of this rebound. For now, investors are taking some comfort in signs that the Chinese government is willing to act decisively to prevent further financial fallout.